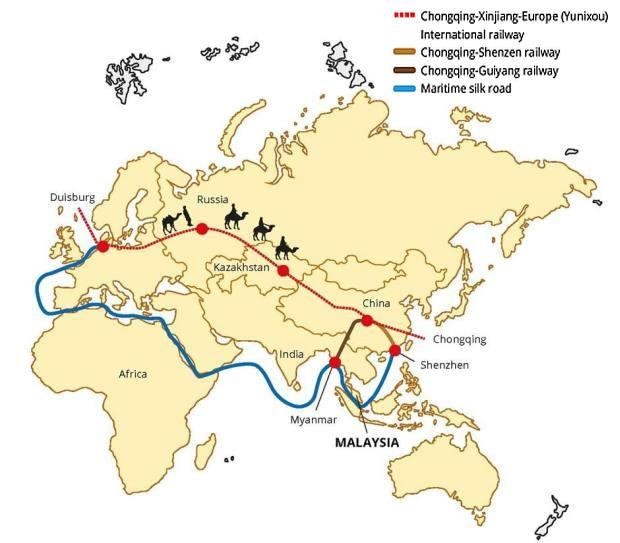

At present China’s economy is the world’s second largest behind the United States and ahead of Japan. The modern iteration of the Silk Road is the New Silk Road economic belt and the 21st century Maritime Silk Road – which in the past linked Asia, Europe and Africa The New Silk Road was proposed to sustain this economic growth and development.

In high-speed rail, China has now taken its expertise global. Having laid more than twelve thousand miles of track, China now has more high speed rail than the entire rest of the world combined. The One Belt One Road will see it take that expertise into connecting China with Southeast Asia.

Whatever the case, these supercharged trade routes and improved infrastructure networks are enabling a more even distribution of manufacturing enterprises across the Eurasian landmass.

With improved connectivity as a result of One Belt One Road, countries participating in the initiative are likely to see an expansion of trade and investment with China.

The entire One Belt One Road project is projected to take 35 years.

Projected investments are estimated to benefit 4.4 billion people in 65 countries.

Besides infrastructural investments in ports, high-speed rail, power generation and other utilities, there are ancillary private-sector investment opportunities in real estate, telecoms, e-commerce, financial, tourism, education, creative industries and green technologies

Naturally, “One Belt, One Road” is not paved with gold. There is no lack of risks, pitfalls and uncertainties, as in any new business realm. But in an era of upheavals and shrinking economic growth, it offers enticing opportunities for Malaysian entrepreneurs, professionals and a multitude of businesses. It can also answer to the spirit of adventure of our younger generation in experiencing the challenges and opportunities of a rising China.

In the long term, it is advisable for Malaysia to avoid a collision course with China, not only because an all-out direct competition with China will be suicidal, but also because the costs in terms of forgone opportunities will be enormous. Seen in these terms, China is a land of opportunity, not a source of threat.

According to China’s statistics, bilateral trade between China and Malaysia amounted to 97.36 billion U.S. dollars in 2015. China continues to be Malaysia’s largest trading partner while Malaysia remains China’s largest trading partner in Southeast Asia.

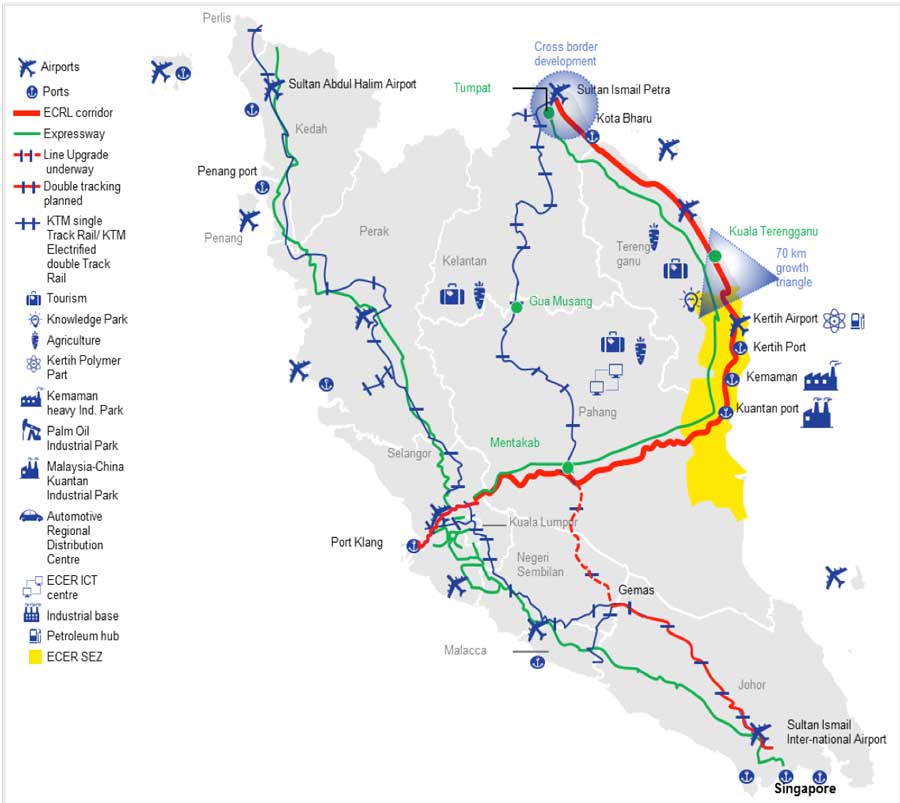

Setting the controversy of costs aside, the recent signing of 14 MoUs with a total value of RM144 billion (S$47.5 billion) witnessed by Najib before a 400-strong business luncheon on Nov 1 stands testimony. The East Coast Rail Project is now another project that open new areas for trade and investments.

And the fact that Jack Ma of Alibaba Group has agreed to advise the Government on our digital economy and China’s richest businessman Wang Jianglin wants to invest in Malaysia speak volumes.

From now on, investments from China in various fields notably in infrastructure, manufacturing, tourism, services and e-economy linked activities are likely to soar if Malaysia acts rapidly and professionally.

This will spur more economic activities and create more jobs.

As foreign direct investments from traditional sources, have shown signs of slowing fast amid global economic uncertainty over reliant on it would be risky. This can be seen in the recent outflow of funds back to US after the US Presidential Election.

Some quarters have, however, expressed fear that Malaysia may be over reliant on China economically while others oppose for reasons best known to them.

If we look around, almost the whole world is wooing Chinese investments and want to engage with China including the Philippines which used to be hostile to China.

Hence, why should we hesitate? Indeed, why should we?

There has been a five and a half times rise in Chinese investor interest in Malaysian real estate. Chinese buyer enquiries for Malaysian properties rose 550% in the year to August 2016 on a property website and Malaysian online property listing views increased by 52.7% in the same time period. Real estate in Malaysia is ranked 11th worldwide in Chinese buyer interest. The average value of property searched for is US$224,000. Charles Pittar, Chief Executive Officer of China’s largest international property website, tells OPP.Today,

“For Chinese buyers, Malaysia is a nearby, easily accessible country with an appealing and very affordable housing market. Money invested there is perceived to be at greater risk than it would be in a larger economy like the US or Australia. Malaysia tends to attract buyers pursuing investment or lifestyle strategies, who have other family or commercial ties to the country or who simply cannot afford to purchase in a market like the US or Australia. The Chinese buyer profile in Malaysia is very different than in nearby Singapore, says the property website, with 54% of buyers in Malaysia motivated by investment, and only 15% by education. This is nearly reversed in Singapore, with 59% motivated by education and 23% by investment. When looking at leading Southeast Asia by enquiries in Quarter 2, 2016, Malaysia is third, behind Thailand (fourth globally on the property website) and Singapore in eighth place. It is ahead of Vietnam, in 14th and Indonesia in 15th. (Source:findproperties168.net).

Briefly, in the real estate arena, China investments in Malaysia will have major impact in the following areas, residential, commercial, retail, services, industrial, infrastructures, education centres, property management, legal and professional services. Some examples are as below.

Increased Tourism; Hotels, Airbnb and Homestay To Prosper

Tourists from China are the third largest in Malaysia comprising 1.7 million or 6.5 percent of total tourist arrivals in 2015, contributing 5.7 billion ringgit in receipts. During the first half of 2016, tourist arrivals from China increased significantly by 32.1 percent.

Both Malaysia and china can be a destination or a source of investment china is a favoured tourism destination for many Malaysians just as is a very good source of vacation visitors to Malaysia but Malaysia should rather seek more opportunities from China than compete with China.

This will augurs well for the development of hotels, Airbnb industry as well as home stay.

Tourism will also have an impact on the retail industry which are now facing increased in vacancy rate.

New opportunities to work with China counterparts in the promotion of real estate services industry

It urged local real estate players to be nimble and adapt to structural development in the Chinese market, including providing new product offering that caters to Chinese and affluent middle class as well as corporate demands to counter the current downturn in the market.

The property management sector will see a rise when China investors bought properties in Malaysia too.

The Chinese are seasoned real estate investors

Some of the notable Chinese investments within Malaysia included Forest City, Greenland, Country Garden and R&F Princess Cove.

Nonetheless, there’s little doubt Chinese investors have played some part in pushing up prices as seen in the Iskandar region. This concern on rising prices is valid. And they will no doubt affect developers holding bad investments. However, the local developers can be more creative and JV with the China investors to overcome their limitations in terms of funding in exchange and advance building technology that hopefully can reduce construction costs, for their expertise in understanding local laws, regulations and markets and penetrating new markets in Malaysia and the surrounding regions. The industrial sector is also an area to be considered for partnership with China to bring in more industrial players in Malaysia.

For property investors

Great opportunities are here for those who dare take the challenge when others are fearful. With the coming development of increased trade, massive infrastructures and investments not just in Malaysia, opportunities are ample and far wider now. Thailand, Vietnam and Cambodia including Myanmar are now areas that one can consider now with the One Belt One Road and High Speed Rail linking all the regions. Hotspots along all these developments are plenty. The unknown areas are now new territories that investors can venture into.

The above is strictly my view as a property investor. Due diligence are a prerequisite in an area of investments be it locally or overseas.

「If this article is useful to you, feel free to buy me a coffee ☕」

If this article is useful to you, feel free to buy me a coffee ☕