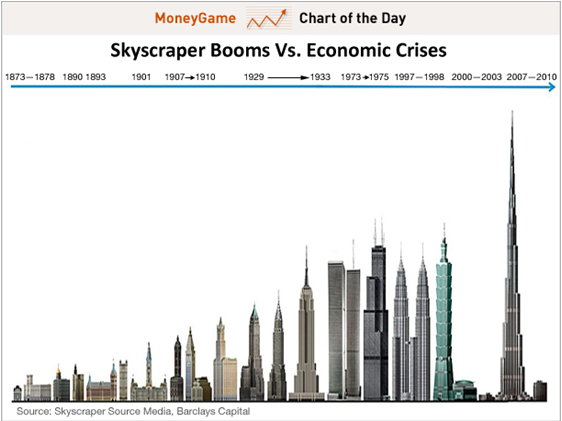

In 1999, economist Andrew Lawrence created the skyscraper index; which purported to show that the building of the tallest skyscrapers is coincidental with business cycles, in that he found that the building of world’s tallest building is a good proxy for dating the onset of major economic downturns. Lawrence described his index as an unhealthy 100 year correlation.

Do Skyscrapers Predict?

Lawrence was apparently the first to make the claim that the construction of the world’s tallest building was correlated with impending financial crisis although the subject of the world’s tallest skyscrapers and their relation to economic crisis is also prominent in Grant (1996).

Lawrence showed that in almost all cases the initiation of construction of a new record-breaking skyscraper preceded major financial corrections and turmoil in economic institutions. Generally, the skyscraper project is announced and construction is begun during the late phase of the boom in the business cycle; when the economy is growing and unemployment is low. This is then followed by a sharp downturn in financial markets, economic recession or depression, and significant increases in unemployment.

The skyscraper is then completed during the early phase of the economic correction, unless that correction was revealed early enough to delay or scrap plans for construction. For example, the Chrysler Building in New York was conceived and designed in 1928 and the groundbreaking ceremony was conducted on September 19, 1928. ‘Black Tuesday’ occurred on October 29, 1929, marking the beginning of the Great Depression. Opening ceremonies for the Chrysler Building occurred on May 28, 1930, making it the tallest building in the world.

As it happens, the world’s tallest buildings have had a habit of being completed right at the top of the real estate cycle. I call the phenomenon ‘the Cantillon effect’: so named after Richard Cantillon (1680–1734), an Irish banker of the early 1700’s.

‘The history of speculative bubbles in construction is paralleled by a history of big increases in debt financing whether it is generated by endogenous factors, gold flows, central banks… or bank regulators,’ wrote Mark Thornton.

Skyscrapers are real estate ventures. Land price goes higher the longer we proceed into the real estate cycle and the more available credit becomes. As the land price rises, taller buildings are required to offset the cost of building a square meter of lettable space.

‘The more the plot of land costs, the taller the building must be to get your money back.’ Of course, one should not study the Cantillon Effect, like any other indicator, in isolation.

Source: Skyscrapers and Business Cycle

Source: Port Phillip Publishing

「If this article is useful to you, feel free to buy me a coffee ☕」

If this article is useful to you, feel free to buy me a coffee ☕